How to Delete My Account on Credit Karma

Credit Karma, the company that turned the promise of a free credit score into a business worth over $7 billion, is joining the ranks of "neobank" startups offering a checking account. The product will be folded into Credit Karma Money, which launched last year as a savings account available to the company's 100 million members.

Digital banking has been gaining steam for the last several years, with the pandemic only accelerating consumers' interest in the options that neobanks are providing. In the U.S. and Europe, there are now over two dozen neobanks, which have collectively raised over $6 billion in venture funding.

"We think this is a product for people who have been left behind in financial services," Credit Karma cofounder and CEO Kenneth Lin says of his company's variation on the theme. Credit Karma Money Checking will not charge fees and will include automated features designed to help users better manage their money, such as bill payment date optimization. Over time, data from Checking will also help the company better present its members with targeted advertisements for loans, credit cards, and more.

"Historically, Credit Karma has been focused on helping people optimize their credit, optimize their borrowing," says Lin. "Now we're moving to the other side of that spectrum. We want to help you save for your future, and this is the connector to making all of the pieces work."

Credit Karma is entering an increasingly crowded market for digital-first checking and savings accounts. Some fintech startups entering the space, such as Chime—which says it is adding hundreds of thousands of customers every month—have made basic banking services core to their business. Others, such as Robinhood and SoFi, are using checking and savings as a way to regularly engage their customers, while they monetize other product lines. In general, consumers say they are open to digital banking: 60% would try a finance product developed by a technology company, if they have an existing relationship with the company, according to CB Insights.

Like Robinhood and SoFi, Credit Karma is less focused on becoming people's primary bank and more focused on generating reasons for consumers to share data on their spending patterns and open its app more frequently. "We're not a bank. What we want to be is the technology that powers consumers' decision to optimize their finances," says Lin.

We're not a bank. What we want to be is the technology that powers consumers' decision to optimize their finances."

Kenneth Lin

But Credit Karma, like other neobanks, still poses a threat to Wall Street—a dynamic that the pandemic has brought into sharp relief. "Branch-based banking doesn't have a lot of value now," says Ryan Falvey, managing partner at Financial Venture Studio. These days, a bank branch is "just an expensive billboard," he says. "It was effective when people were walking by. It has no value now when people aren't leaving their houses."

Falvey sees signs that COVID-19 has leveled the playing field between digital banks and legacy institutions, if not tipped the scales in favor of the upstarts. "The banks are at a disadvantage, frankly."

For now, Credit Karma Money Checking will only be available to the 2.5 million members who have already opened a Credit Karma Savings account. The company plans to launch the product more broadly in early 2021.

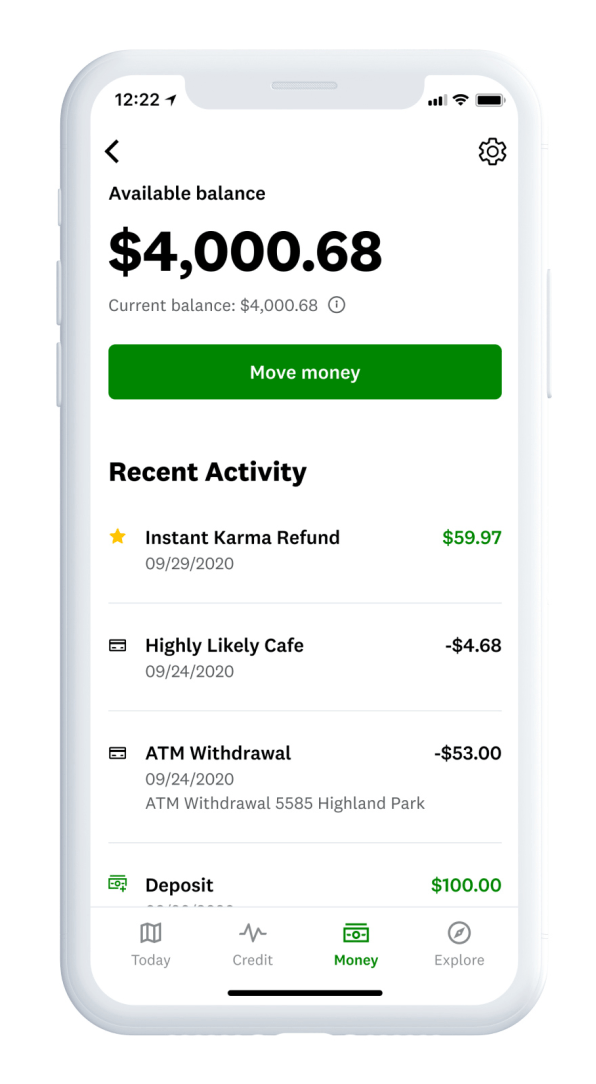

By then, Credit Karma expects to have incorporated features including early paycheck access and automatic bill pay. It will also attach an "Instant Karma" rewards program to Checking, doling out cash prizes in return for good financial behavior. The program ties into a broader tendency: As younger consumers trend away from credit cards and toward debit cards, an increasing number of companies are experimenting with points-based debit rewards designed to mimic the spending incentives that credit cards long ago mastered.

"It's a randomized way for us to give that pat on the back," says Poulomi Damany, general manager of Credit Karma tax and assets, which "keeps people motivated."

Looming over the launch is the question of Credit Karma's sale to Intuit, maker of TurboTax, for $7.1 billion. Announced in February, the deal has yet to close, as regulators examine how the combined organization would affect the market for tax-preparation software. Credit Karma introduced a free tax-prep product in 2017, following a decade in which TurboTax went largely unchallenged.

Last year, 40 million Americans filed their taxes via TurboTax. Parent company Intuit has been criticized for effectively reneging on its promise, made in a deal with the IRS nearly two decades ago, to provide a free filing option for lower-income households.

"The transaction was never about the tax product. It was about the vision," says Lin. "We've always said [closing the deal] was something that was going to happen in the second half of the year; we still believe that's the case."

Like Credit Karma Money Checking, Lin views the company's tax product as a way to gather data and further optimize the company's ads. "How do we understand you better and create more certainty in the product to get you to that better place?" he says. "That opportunity doesn't change [with the prospective acquisition]; it actually gets amplified."

How to Delete My Account on Credit Karma

Source: https://www.fastcompany.com/90557449/credit-karma-free-checking-account

0 Response to "How to Delete My Account on Credit Karma"

Post a Comment